Residential Markets

My career has been spent largely in commercial architecture. However, I find myself increasingly involved with our firm’s original specialty as sdg Architecture / Shorelines Design Group continues to expand our legendary residential home market. We are designing new houses for customers in the Tampa Bay area and well beyond. Our market includes Hillsborough, Pinellas, Pasco, Manatee and Sarasota counties. Additionally, we were approved for development at Sugar Sands, near Mexico Beach in the panhandle of Florida, for a development of rental houses. Our firm has also been recently accepted by another developer near Panama City, one of four.

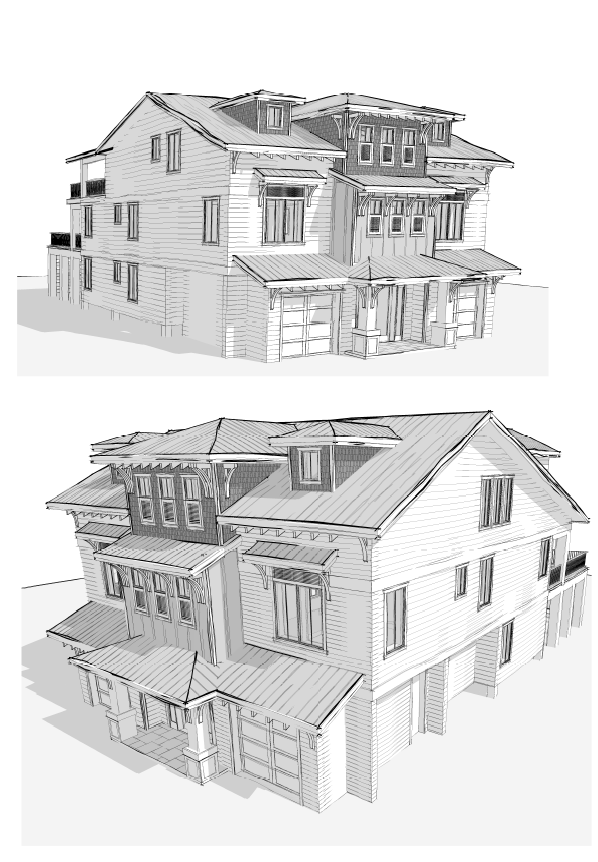

Many of these projects are large, unique homes on expensive beachfront properties and in golf course (country club) communities. You will find images of some of our most notable projects in this post. We all know that interest rates have gone through the roof, so who is buying?

Millennials

Tim Gilpin, Partner and Senior Building Designer sdg Architecture / Shorelines Design Group, explains that while the Millennial generation came on strong in the housing market in the past few years, funding and interest rates have dramatically increased. There are aging Baby Boomers and some younger millennials in the forty to fifty age range who have the cash to avoid financing.

“Millennials were born between 1980 and 1998. Many are renters and/or live at home, have large amounts of student loan debt and suffer long-term unemployment,” noted Gilpin in a blog post in late 2017. He noted that they tended to prefer “a small-town feel,” in an urban environment walkable from work and home. Many Millennials focused early in their lives on education and finances and now prefer larger houses in suburban environments as their families and incomes have grown.

The North

Northern housing markets have slowed with some projects stalled in construction, people are migrating to Florida from big cities in the northeast and mid-west for more affordable housing and warm winters. The pandemic forced the early retirement of many people who also decided to come south despite the heat, humidity, hurricanes and flooding.

We are not having quite the same problem as other markets with new starts on the west coast of Florida. U.S. News & World Report stated in 2021 that of the best 25 American cities in which to retire, 13 are in Florida. A 2021 report by Lily Katz, Principal Data Journalist at Redfin Real Estate and Ben Walzer, Red Fin Journalist, states that eight of the nation’s top ten 2022 real estate growth cities are in Florida, with six of those in the Sarasota area, including South Sarasota, East Venice, Englewood, Venice, Nokomis and The Meadows. The west coast of Florida also includes Downtown Fort Myers, and the east coast includes Weston, according to the report.

While that was good news in 2021, today smaller home builders in Florida are experiencing a slowdown with new starts, particularly in tract home developments. The market remains strong for those who have their own cash and can escape paying current loan rates. Our market for homes in the 2-to-4-million-dollar range and up tends to be for builders and buyers for whom paying cash is no problem.

Additionally, as the overall market slows, the inventories of building materials are increasing and the prices are falling. Many cash buyers don’t want to insure for storm damage after the home is finished, taking their own risk of major expenditures for future damage by sidestepping the skyrocketing rates for storm and flood insurance.

Whether you are a builder or homeowner, our team of thirteen professionals at sdg Architecture / Shorelines Design Group has the portfolio to show that you have come to the right place.

Other blog about the market here in Florida:

Be the first to comment